SMALL BUSINESS GUIDES

Your guide to tax in Australia

Division 7A Explained

Division 7A is a provision under the Income Tax Assessment Act that prevents private companies in Australia from distributing profits to shareholders (or their associates) without paying tax. Because of Division 7A, you cannot use your company bank account as...

Division 7A Explained

Division 7A makes sure businesses can’t disguise taxable shareholder income from the ATO. Here’s what you need to know.

Understanding Withholding Tax For Small Business

Withholding tax from employee paychecks is standard practice in Australia, so here’s what small businesses need to know.

Online Tax Return Guide

Filing your tax return online with the ATO is pretty straightforward these days, but there are some key things you need to know first.

Superannuation Guarantee (SG) Explained

As a small business owner, you must pay eligible employees super at a certain rate. Let’s unpack the Superannuation Guarantee.

Guide To Small Business Income Tax Offset

The Small Business Income Tax Offset (SBITO) can be a useful way to boost your small business cashflow. Here’s how it works.

Understanding Tax Rates in Australia

Tax rates in Australia are progressive, meaning the more you earn, the more tax you’re liable to pay. Here’s what small businesses need to know.

Tax File Number application in Australia

If you wish you get paid in Australia, you probably need a Tax File Number (TFN). Here’s how to make a TFN application to the Australian Taxation Office (ATO).

Understanding franking credits

What exactly are franking credits and why do you need to understand them? Franking credits ensure shareholder dividends are not taxed twice. Let’s dive into the details.

Guide to Taxable Payments Annual Report (TPAR)

If you hire contractors in certain industries, you may well need to file a TPAR or Taxable payments annual report. Find out what it is and whether you need to file one with the ATO.

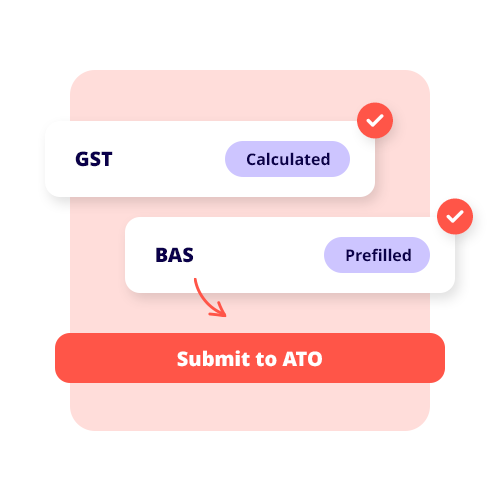

Download your free GST guide

GST guide

There’s a lot to get your head around when you’re starting a new business, and GST is just one bit most fledgling business owners will need to get to grips with. If you’re looking for help, download our free guide to better understand GST.

Discover other small business resources

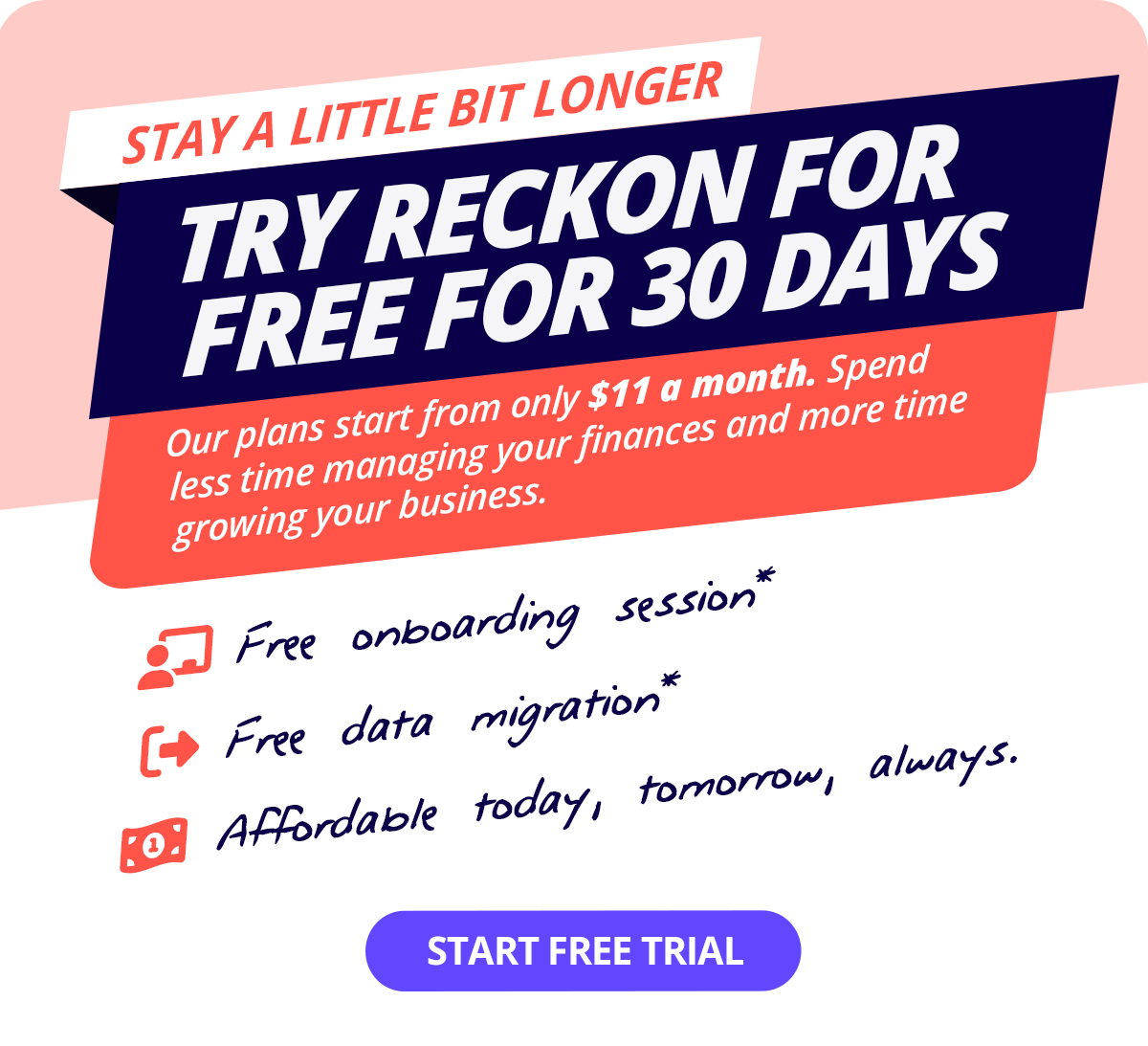

Try Reckon One free for 30 days

Cancel anytime.